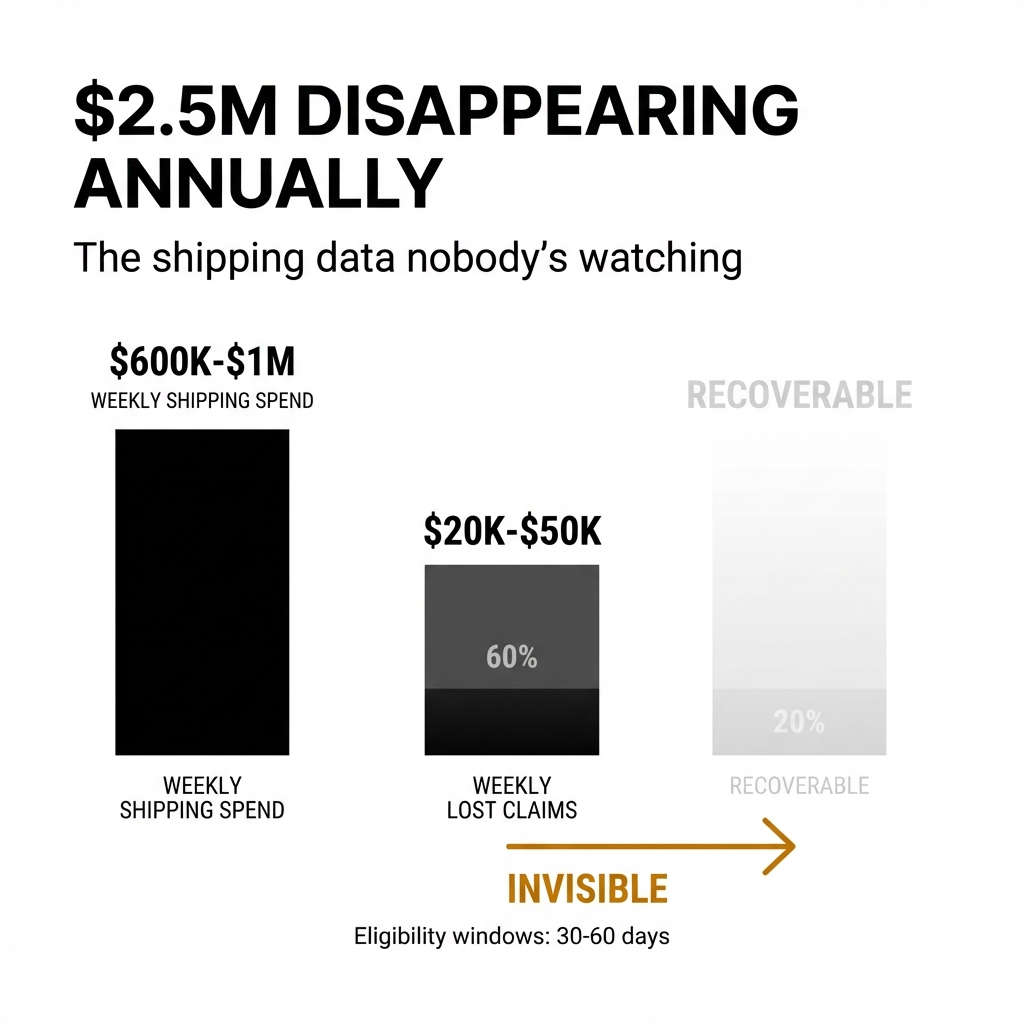

Quick Summary: Organizations shipping at scale systematically abandon $1M to $2.5M annually in recoverable value because shipping data lives disconnected across spreadsheets and departments. The problem compounds after 10,000 weekly shipments when manual coordination becomes structurally impossible. Claims filing acceleration doesn't solve this. Data connectivity infrastructure does.

Core Answer:

-

Shipping data disconnection costs high-volume shippers $20K-$50K weekly in abandoned claims alone

-

Manual coordination collapses at 10,000+ weekly shipments due to volume multiplication plus carrier and brand complexity

-

Industry tools accelerate filing but ignore root cause: incomplete data assembly creates 10-20 percentage point approval rate gaps

-

Connected data infrastructure unlocks claims recovery, real-time auditing, network optimization, and rate impact analysis simultaneously

Who Owns Your Carrier Login?

This question comes first when analyzing shipping operations. The answer reveals whether recoverable value is accessible or abandoned.

Half the organizations analyzed don't know. The person who set up the UPS account left three years ago. FedEx login credentials live in someone's personal email. USPS access got written on a sticky note somewhere.

Without carrier data access control, recovery becomes impossible. But the pattern that emerges shows even organizations with perfect login access abandon massive recoverable value. They're sitting on shipping data containing actual cash and treating it like operational exhaust.

What Creates the Awareness Gap

Spreadsheets signal the problem. Data in spreadsheets ages from the moment you save. It's static, disconnected, and at scale that disconnection costs real money.

The pattern observed across dozens of organizations shows companies shipping 50,000 boxes weekly lose $20,000 to $50,000 in eligible claims every week. Not from incompetence or laziness. They lose it because they don't realize they're losing it.

The data isn't centralized. Claims volume monitoring doesn't exist at sufficient granularity to reveal what's missing. Nobody owns the problem end-to-end.

Customer service triggers claims when customers complain. Operations diagnoses failure modes. Finance collects payments. Three departments, three handoffs, zero ownership of results. Research shows 82% of enterprises report data silos disrupting critical workflows. Shipping operations follow this pattern.

Pattern Recognition: Fragmented ownership across departments prevents anyone from seeing systematic value leakage, even when individual components function correctly.

Why Do Organizations Accept This Loss?

Organizations losing $20,000 to $50,000 weekly in claims spend $600,000 to $1,000,000 per week on shipping. Relative to total spend, abandoned claims don't register as the primary problem.

The math looks rational on surface examination. But multiply across a year and you're looking at $1 million to $2.5 million in recoverable value evaporating.

The actual issue is visibility. When shipment details live in one spreadsheet, returns data in another, and product values in a third, pattern recognition becomes impossible. Claims eligibility windows expire (30 to 60 days from shipment date) while teams wait for someone to send the correct spreadsheet or gather invoice proof of value.

Manual data assembly takes time. Every download, every vlookup, every save introduces error opportunities or data corruption. At enterprise scale, any inflection point occurring in real time gets buried under transaction volume accumulating since that inflection occurred.

Core Dynamic: Per-unit recovery economics look prohibitive while aggregate economics justify infrastructure investment, but disconnected data prevents organizations from seeing aggregate opportunity.

Where Does Manual Coordination Collapse?

At 1,000 shipments per week, managing claims manually is difficult but possible. Organizations handle one to five claims. At 10,000 shipments weekly, the volume reaches 10 to 50 claims. Coordination starts breaking at this threshold.

The collapse happens at 100,000 shipments per week. Now you're managing 100 to 500 claims weekly. At a million shipments, that's thousands to 5,000 claims per week requiring justification and management.

Loss and damage occur at a fraction of 1% of total shipments. The problem isn't the percentage. It's volume multiplication combined with carrier diversification and brand complexity. Organizations manage more claims across multiple carriers, multiple brands, and multiple third-party arrangements.

Manual coordination collapses completely at this threshold. Not because effort is insufficient. Because coordination geometry at scale makes it structurally impossible.

Volume Threshold: At 10,000+ weekly shipments, coordination complexity compounds faster than linear scaling, making manual assembly systematically fail regardless of resource allocation.

How Has the Industry Misdiagnosed This Problem?

The shipping industry responded with tools accelerating claims filing. File faster. Submit more claims. Batch process everything.

This treats symptoms, not causes. The problem isn't filing friction. It's data disconnection and procedural incompleteness.

Most outsourced claims providers deflect all claims to their platform focusing on one objective: getting claims filed. They don't prioritize data completeness. They don't provide defensible proof of value documentation. They don't monitor marginal claims or macro trends across the claims ecosystem.

They're generating filing activity without understanding why claims perform the way they perform. Reporting to substantiate results doesn't exist.

Misalignment: Industry optimizes for activity metrics (claims filed, tickets opened) rather than outcome metrics (payments received, reconciliations completed) because upstream intervention requires less infrastructure investment.

What Happens When Incomplete Claims Get Filed?

When claims go in with basic information but not complete information, carriers take one of two actions. They reject outright, or they contact the shipper requesting more information.

At scale, responding to thousands of these requests becomes impossible. Shippers don't have capacity to provide details for every marginal claim. Outsourced providers don't have connectivity to the shipper's business. They only possess enough information to get claims filed initially.

Here's what gets missed: carriers aren't denying claims to protect margins. They're trying to process claims but encounter information gaps. They need complete shipper and customer details. They need proof of value documentation. They need full merchandise descriptions because they actually attempt to locate lost packages.

The adversarial framing persists because getting everything right is genuinely difficult. Shippers and their customers experience claim denials they believe were valid. Those claims probably were valid, but didn't follow exact protocols carriers need to approve claims and submit information to underwriters.

Structural Reality: Carriers benefit from reduced incomplete-claim volume and complete-information submissions, but adversarial positioning prevents recognition of this alignment opportunity.

How Do You Benchmark Claims Performance?

Claims bucket into two categories. Loss claims (non-proof of delivery) and damage claims. Damage claims are wildly diverse. Success rates depend on packaging quality and materials. Benchmarking is difficult.

Loss claims are definitive. When you do everything correctly, loss claims should get accepted at very high rates. When data assembly is done correctly, loss claims get approved at higher than 80% on average. In many cases, higher than 90%.

The gap between those numbers and what most organizations achieve traces to proper setup and completeness. Shippers with almost all claims denied often have multiple brands or drop-shipping arrangements without appropriate third-party shipment claim setup.

In most cases, it's simpler. Missing proof of value documentation. Incomplete contact information. Vague merchandise descriptions that don't help carriers during search processes. These aren't complicated problems. They're coordination problems becoming impossible to solve manually at scale.

Benchmark Insight: Loss claims serve as litmus test for process completeness because approval should exceed 80-90% when information assembly is correct, revealing whether fundamental coordination infrastructure exists.

What Does Data Connectivity Unlock Beyond Claims?

Once you solve data assembly, claims become nearly autonomous. Other optimization opportunities that were always present but invisible suddenly become accessible.

Real-time operational auditing becomes possible. Organizations identify changes in parcel operations or billing behavior requiring immediate attention. Anomaly detection catches cost overruns before they compound. Teams flag issues, escalate them, and dispute when necessary.

Network optimization becomes accessible. Organizations re-rate existing volume and identify opportunities to push shipments to alternative carriers accepting their specific parcel profile at significant discounts without impairing transit times. Teams scenario model network strategy in real time.

Rate change impact analysis becomes automatic. When UPS or FedEx announces changes to surcharge calculations or peak pricing, organizations understand cost structure impact immediately and introduce those topics to carrier reps for negotiation before overruns materialize.

These aren't separate problems requiring separate solutions. They're all downstream applications of the same data connectivity infrastructure. Organizations don't see this pattern because the industry has always sold these as independent services.

Parcel audit was its own service. Claims were a cousin service, an ad hoc add-on. Contract management and network strategy were never productized. So shippers treat them as independent when they all rely on the same foundational data layer.

Infrastructure Leverage: Data connectivity built for claims recovery simultaneously enables auditing, network optimization, and rate analysis because all share the same foundational requirement: connected, complete, real-time data streams.

Why Is This an Infrastructure Problem, Not a Tools Problem?

The shipping data problem isn't a claims problem or an audit problem or a network optimization problem. It's an infrastructure problem. Organizations solving data connectivity unlock all these optimizations simultaneously. Organizations treating shipping data as isolated tactical concern remain trapped in coordination failure.

ShipScience spends time on the front end connecting data sources. The platform gathers information about brands, shipping profiles, and operational patterns. Setup details get completed so claims go through with full information and don't get stuck in carrier processing. When claims do get stuck, the system monitors for those events and fills in requested information to push them through.

Claims are the proof case. The same infrastructure enables active auditing, network optimization, and rate impact modeling. Once data is connected, these capabilities emerge naturally.

The question isn't whether your shipping data contains value. It does. The question is whether you're building infrastructure to extract it, or whether you're content watching $20,000 to $50,000 per week disappear into eligibility windows while teams wait for someone to send the correct spreadsheet.

Strategic Decision: Infrastructure investment amortizes coordination cost across entire transaction volume, transforming per-unit economics from prohibitive to profitable at scale.

Frequently Asked Questions

At what shipment volume does manual claims management become impossible?

Coordination starts breaking at 10,000 weekly shipments and collapses completely at 100,000 weekly shipments due to volume multiplication combined with carrier diversification and brand complexity.

Why don't outsourced claims providers solve this problem?

Most outsourced providers optimize for filing activity (claims submitted) rather than outcomes (payments received). They lack connectivity to shipper business systems needed to assemble complete information, so they file with basic data and don't monitor why approval rates vary.

What's the difference between filing faster and filing completely?

Filing faster accelerates submission but doesn't address data completeness. Complete filing requires connected data streams providing proof of value, full contact details, and merchandise descriptions before submission occurs. Completion drives 10-20 percentage point approval rate improvements.

How do carriers actually benefit from better data?

Complete information reduces carrier processing costs by eliminating triage requirements and follow-up requests. Carriers attempt to locate lost packages and validate damage claims, so better descriptions and documentation make their processes more efficient while improving shipper recovery rates.

What KPIs indicate shipping data disconnection problems?

Organizations experiencing data disconnection typically don't know: who controls carrier admin logins, average cost per package by brand and service, average transit time by service and geography, or claims rates and approval rates by loss versus damage.

Why do eligibility windows cause systematic value abandonment?

Claims eligibility expires 30-60 days from shipment date. When shipment details, returns data, and product values live in separate spreadsheets requiring manual assembly, coordination time exceeds eligibility windows at scale, causing automatic forfeiture.

What other optimizations become possible after solving data connectivity?

Connected data infrastructure enables real-time operational auditing with anomaly detection, network optimization through carrier mixing analysis, and automatic rate change impact modeling for negotiation preparation.

How does third-party shipping complicate claims at scale?

Multiple brands or drop-shipping arrangements require specific third-party shipment claim setup with carriers. Without proper configuration, claims get systematically denied regardless of validity. This setup complexity becomes unmanageable manually above 1,000 weekly shipments.

Key Takeaways

-

Organizations shipping 50,000+ boxes weekly systematically abandon $1M-$2.5M annually in recoverable value due to data disconnection across departments and systems

-

Manual coordination collapses at 10,000+ weekly shipments when volume multiplication combines with carrier diversification and brand complexity, making per-claim assembly structurally impossible

-

Industry focus on filing acceleration treats symptoms while ignoring root cause: incomplete data assembly creates 10-20 percentage point approval rate gaps and generates carrier processing friction

-

Loss claims serve as process litmus test because proper setup should yield 80-90%+ approval rates, revealing whether foundational coordination infrastructure exists

-

Carriers attempt to process claims but require complete information; adversarial framing prevents recognition that better data reduces their costs while improving shipper recoveries

-

Data connectivity infrastructure built for claims recovery simultaneously unlocks real-time auditing, network optimization, and rate impact analysis because all share the same foundational requirement

-

The strategic choice is between infrastructure investment that amortizes coordination cost across transaction volume versus accepting permanent value leakage as operational exhaust

What pattern are you observing in your shipping operation that you haven't been able to quantify yet?